Inflation Reduction Act Measured Pathway Q&A

Section 50121 of the Inflation Reduction Act (IRA) authorized $4.3 billion for Home Energy Performance-Based, Whole-House Rebates, also referred to as Home Efficiency or HOMES rebates. There are two pathways under the HOMES rebates—the Modeled Approach and the Measured Approach. Under the Modeled Approach, rebates are provided based on projected energy savings; and under the measured approach, rebates are provided based on actual energy savings. This Q&A provides detailed information about the Measured Savings Approach through answering questions that have been brought up in meetings and webinars about the rebates programs.

How are HOMES Measured Savings Incentives calculated and paid?

The measured performance path of the IRA Homes legislation pays for measured savings based on a rate calculated in the formula outlined in the legislation:

- a payment rate per kilowatt hour saved, or kilowatt hour-equivalent saved, equal to $2,000 for a 20 percent reduction of energy use for the average home in the State; or

- 50 percent of the project cost;

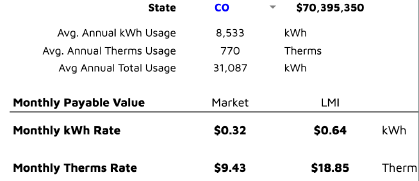

The calculation of payment rate is derived by taking 20% of the average energy consumption of homes in a state, dividing that number into $2K for market rate or $4K for low-income households, and that determines the payable rate, which then pays for measured savings at that rate, paid to the aggregator by the end of 12 months (some current programs make payments monthly, quarterly, or yearly).

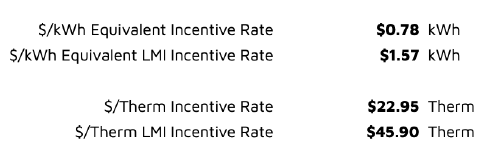

It looks like this every month (Colorado example):

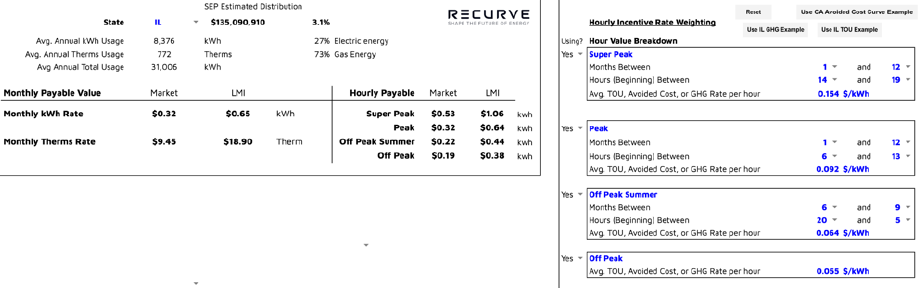

For cases with a smart meter and hourly energy data, the legislation requires hourly savings “when available” (meaning where there is Advanced Meter Infrastructure or AMI). It allows payable kWh and kWh-equivalent (kWh-e) based on time, location, and Greenhouse Gas (GHG) value. Each state will be able to choose the weighting of time and/or GHG impacts, which will help both maximize impact and also maximize accessibility for states and territories that have less potential for monthly kWh reductions.

Could a state tailor the incentive rate in its plan for HOMES to offer a higher incentive rate based on Time of Use (TOU) or GHG/grid value?

Yes. A single kWh has a different value to a customer, grid reliability, and the climate depending on the time of day and thus is not an expression of the actual value of savings in many states, especially those with high levels of renewable penetration.

In the case of electrification projects from fuel switching, the projects may increase annual kWh usage (which is why HOMES allows for kWh-e to account for therms). Still, at the same time, there can be significant grid value in measures with significant savings in peak periods.

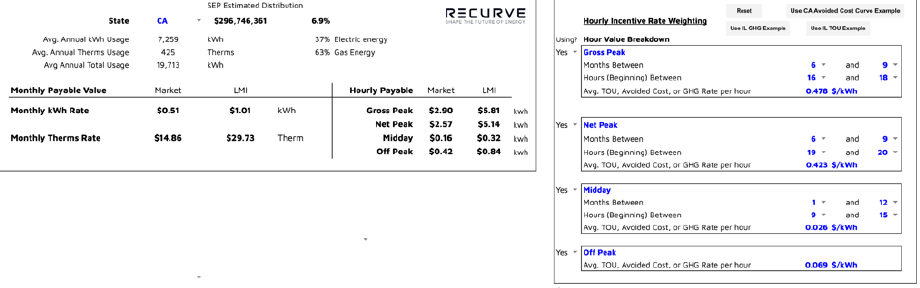

The law notes that state plans must include a plan “to value savings based on time, location, or greenhouse gas emissions,” This value can be added to the kWh-e to account for the additional benefit. This could be the Avoided Cost values, TOU Rates, Hourly GHGs, or simply prioritizing certain peak hours.

Because the legislation establishes the payment rate pegged at $2,000 for 20% energy savings (or time, location, and GHG value), only the differential value per hour is required (not the units), and this can easily be applied. Here are two examples:

Illinois example based on hourly TOU rates:

California example using Avoided Cost data:

What is envisioned for situations where historical energy data is unavailable or available at unpredictable intervals, like oil-heated homes or locations where estimated meter reads are common?

Estimate meter reads are not an issue, as those estimates are typically updated with actual meter reads, and when that happens, those actual reads can be used.

For homes without any historical energy data (moved in recently, delivered fuels without records, etc.), there are a few options:

- Calculate savings based on the portfolio average: If there is a mix of sites in a portfolio, one can handle this lack of data by stipulating significant outliers due to non-routine events (NREs) and assigning savings based on the portfolio average, assuming the percentage of these projects are reasonable as a share of the portfolio.

- Calculate savings based on non-measured models: These sites would be a place to utilize calibrated models or existing programs using deemed values. However, it is important to calibrate savings predictions as there is a demonstrated trend toward over-estimation in both modeled and deemed approaches.

- For a fuel-switching project, one can use the measured new heating loads on the electric side and work backward to estimate the fuel usage by converting the electric heating load with a factor for efficiency into heating.

For homes with unpredictable data (e.g., delivered fuels):

-

- Aggregators collect delivery records from customers (or their fuel suppliers) to calculate baseline energy characteristics.

- Combine historical delivery records with ongoing sensor data on delivered fuel tanks (similar to #1 above).

- Calculate savings based on the portfolio average (same as #1 for homes without historical data).

- Calculate savings based on non-measured models (same as #2 for homes without historical data).

Are there any examples of programs using measured savings for the whole house (e.g., seal and insulate) type projects?

Yes, many programs are using measured savings for whole-house projects.

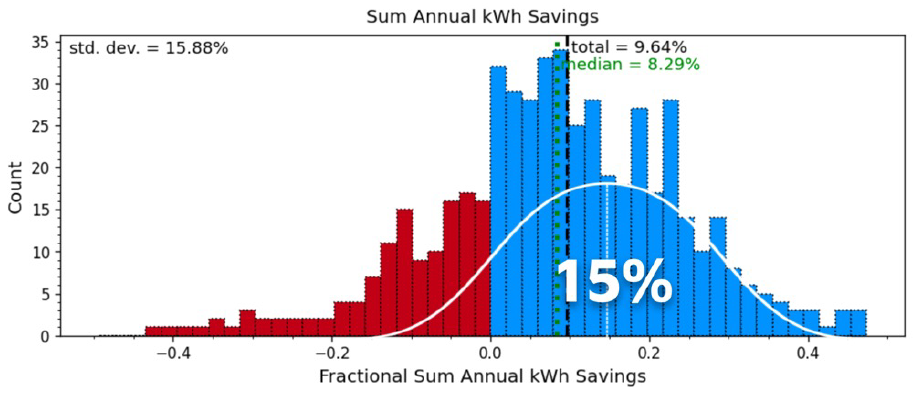

In the utility program context, Franklin Energy’s Comprehensive Home Retrofit (CHR) program in PG&E territory has been successfully implementing Shell, Shell + HVAC, and Electrification projects. These programs delivered reliable and significant savings, especially during peak periods, and were paid based on weather-normalized open-source advanced Measurement and Verification (M&V). These portfolios delivered greater than 15% measured savings.

The 3C-REN (Regional Energy Network of local governments on the central coast of California) is running a hard-to-reach, low-income residential electrification market. (Learn more here). Aggregators, mostly local contractors, are paid for actual performance based on advanced open-source M&V with value adders for customers who qualify as hard-to-reach. These adders increase the value of reducing natural gas to improve the value proposition for heat pump electrification.

In the private sector, companies such as Sealed offer a performance financing contract. Sealed is only paid based on actual energy reductions defined by past usage (adjusted for weather) minus actual usage. Sealed is currently deployed in six cold weather states (NY, NJ, CT, PA, IL, WI) and sees greater than 15% savings in its portfolio.

Is it possible for HOMES and High-Efficiency Electrification Rebates (HEERA) to be used in the same home (but for different energy upgrades)? How would this be done? And, if it would be impossible to distinguish measured energy savings when combining funds (HEERA and HOMES) in a single home, would using a measured approach necessitate not allowing a home to benefit from both funds? That seems problematic for a whole-home energy improvement approach.

Yes. The legislation is clear that they can both be used as long as they are not for the same measure, such as a new heat pump. As a reminder, HOMES is available to all homeowners, and HEERA is income-qualified for Low and Moderate Income (LMI) homeowners only.

One method to use both incentives would be to measure the savings or load shape impact on heat pump-only retrofits and then subtract those measured average savings that have been calibrated to the treated customers from their whole-building measured savings. This effectively isolates the additional non-heat pump impacts. Each program may have different benefits for the provider and the consumer that will naturally lead some to choose one rebate or the other, rather than tackling the challenges of blending.

Modeling will allow the heat pump removal from the calculation for one home; however, achieving 20% reductions required by HOMES without incorporating the measures in HEERA will be difficult. The law intends to treat these programs separately. The heat pump incentives in HEERA are so great, and a big piece of the home's performance that focuses on the HEERA incentives would likely be preferable for an LMI customer. However, efficiency and energy burden, are still important to comfort and customer experience, and thus thinking about combined measures (insulation and HVAC) is critical.

Some states may run out of their HEERA rebate funds. The California TECH program deployed $28M in heat pump rebates at $3K a unit in only six months, running out of money and painfully having to shut down with little warning with six months left in the year. In New York, Con Edison’s Clean Heat Program experienced a similar market dynamic. Thus, it may be preferable for an LMI customer to use the HEERA funds for one year and then establish a new baseline and undertake a measured performance approach focusing on performance and greenhouse gas reductions.

How important is utility data sharing and is data sharing likely to be based on Green button connect?

Data sharing is important, there are models in the marketplace today that offer good examples for secure data sharing, and the IRA requires that DOE publish best practice guidelines on data sharing. Data sharing via Green Button Connect is not necessary, although beneficial, to enable a measured savings approach. The data required for measured savings can be provided by aggregators (authorized by customers), utilities (with or without customer authorization), or some combination thereof.

Currently, utility partners are engaged in most instances of ratepayer funded measured performance programs. Thus, customer-level approval and data are not required because savings are calculated by a utility host who already has access to customer and non-participant data. The results are reported either at a customer level or in the portfolio.

Because methods and code are open-source, verifying the calculations without sharing the underlying data is possible. Rather than sharing raw customer smart meter data, the results are shared and auditable. This approach to Advanced M&V is widely utilized by utilities such as ComEd, Con Edison, National Grid, Duke, APS, PG&E, SCE, SoCalGas, SDGE, Energy Trust of Oregon, Ameren, DTE, and more.

If utilities are not able or willing to share data directly, aggregators can access the data necessary to measure savings. Today, companies like Sealed that provide measured savings financing products in the private sector collect energy data in various ways, including from the customer directly and by leveraging utility-provided tools like Green Button Connect and/or third-party energy data tools (such as those provided by companies like Arcadia, UtilityAPI, etc.). Aggregators can also leverage low-cost sensors that can track energy data, including from delivered fuels, so long as those sensors are installed with sufficient pre-intervention time (12 months) to establish baseline usage.

The IRA calls on DOE to publish guidelines on data sharing to support states who need this assistance.

Can you confirm that states will choose between a measured OR modeled approach? Or might some states (admin issues aside!) have both pathways available?

The legislative intent is for states to have the option to offer either or both pathways. Because these programs were authorized and appropriated through 2031, DOE should allow states flexibility. Should a state choose to put in place a measure/modeled program in 2023, they should be allowed to put in place another pathway in a future year.

What if a house's heating and cooling equipment is not working well, so the recent year(s) bills are low as they didn’t run the equipment? Actual bills would be low, but at a huge comfort cost — how do we handle modeling and measuring savings?

This is an issue that both the modeled and measured pathways would need to address. The updated system will lead to better cost and comfort outcomes if heating and cooling are running poorly. If the HVAC system is not working, which is a take-back for comfort, adding HVAC is a net increase in consumption. While comfort is an important customer attribute, it is not a mutual benefit (to the program), so these projects would correctly show low and sometimes zero savings. The HOMES IRA program does not reward consumption increases; therefore, any aggregators with these homes in their portfolio would receive no incentives for those projects.

This can be addressed by identifying those customers in advance and serving them with solutions such as lighting or appliances that will save energy or a different program. This is also where the 25C tax incentive or the HEERA rebate, based on the measures installed and not the energy savings, may assist the customer homeowner in their upgrade.

Is there a sunset on the rebate dollars available to states?

2031, but 2 years after enactment (August 16, 2022), DOE can redistribute funds from states who have not applied for their funds to states in deployment.

Does the measured savings pathway not require building-specific baselines? Why the difference from the modeled approach?

Measured savings is paid at the portfolio level, but consists of savings aggregated from calculated savings relative to a baseline for each customer. This baseline is determined based on a disaggregation of each customer and sometimes coupled with a non-participant comparison group to account for macro effects such as COVID and extreme weather.

If BPI is updating their 2400 standard, do you expect it might allow for prototype or stock buildings calibrated to average every usage. Would this put it more or less on par with the measured savings pathway?

While BPI may make updates to the current BPI 2400 standard, the legislative intent and additional text are clear that models are calibrated to “historical energy use” or actual customer consumption levels, and any subsequent change to the standard to deviate from that would also deviate from congressional intent.

Stock buildings or average / deemed models are expressly not part of the HOMES program design as it is intended to address actual home energy use. It would move it further away from the measured approach, not closer.

What happens when a home in a measured approach has less than 15% savings? It is part of a portfolio. Is it then removed from the portfolio?

The measured approach focuses on portfolio-level performance that achieves 15%. If a portfolio were to hit 15% on the dot, then 50% of the customers in that portfolio would have lower than 15% savings. This is by design. Individual projects would stay in the portfolio. For any projects removed from a portfolio, the aggregator cannot be reimbursed for the upgrade incentive.

What happens if an aggregator’s portfolio doesn’t achieve the 15% savings threshold?

All projects accepted into a portfolio should first qualify as having a forecasted value that exceeds 15%. However, if the portfolio is underperforming that estimate and falls below 15%, there are few possible programmatic solutions.

First, the realization rate of the portfolio could be used to adjust future predictions so that predicted values are calibrated to ensure the portfolio delivers 15% overall. One of the advantages we see happening in measured programs is continuous improvement. Predictive accuracy increases dramatically with better data over time.

Second, aggregators may drop underperforming projects from their payable portfolio until they arrive at a portfolio of payable projects that achieve 15% savings. The aggregator would not get paid for any customers not in the final portfolio (though those customers would still receive any upfront incentive from the aggregator). This is where the aggregator takes the risk and contractors are incentivized NOT to over predict as it would skew the portfolio.

Can you say more about the Puerto Rico and Hawaii cases and how they might address the challenges of attaining the minimum savings thresholds?

Achieving 15% savings is a challenge, as non-HVAC home performance projects may only achieve savings on average in the 10% to 12% range in states with milder climates.

Hawaii is an interesting example. Because the usage is low, measured performance payable rates are the highest in the country, which should lead to significant demand. Additionally, Hawaii has significant peaks, so utilizing time-based payments will make achieving a 15% value reduction substantially easier.

Solving this issue, however, comes down to two solutions.

- Instead of using the HOMES program standard kWh/kWh-e payable rate, these states should utilize time, location, or GHG-based payable rates. Using these alternative payable rates makes peak hour energy reductions much more valuable than off-peak from a combination of peak hour value, and GHG value since Puerto Rico and Hawaii have significant fossil fuel electricity generation.

In California, for example, using the Avoided Cost Calculator rates, 70% of the kWh-e weighted time-value is in just five peak summer hours. By focusing on these peak hours, an aggregator could achieve a 15% kWh-e weighted time-value reduction with only a 6.6% peak energy reduction.

- Targeting customers with a high potential for savings (in general) and specifically for peak savings can vastly change the outcome of programs. In the Franklin Energy Electrification Measured P4P program in California, the top 50% of customers (who can be identified in advance) have 400% greater peak savings than the bottom 50%. Focus on those customers first.

Who would take the risk of being on the hook for measured savings? And who is going to carry the cost for 12 months?

In the private market, we see various aggregators and investors prepared to accept energy efficiency’s performance risks. Companies like Franklin Energy, CLEAResult, ICF, and others are all participating in pay-for-performance programs based on measured savings and providing incentives to customers while getting paid on performance.

Additionally, companies such as Sealed, OhmConnect, BlocPower, SunRun, and others also provide variations on performance guarantees. These companies work with investors, including green banks, to finance these cash flows.

Can HOMES rebates be combined with the Low Income Home Energy Assistance Program (LIHEAP), the Weatherization Assistance Program (WAP) program, and the 25C energy efficiency tax credit?

There is nothing in the law that prohibits combining the tax incentives with the HOMES incentives. However, WAP is a grant program that helps low-income homeowners weatherize their home, and the legislation prohibits combining with other federal rebates or grants. LIHEAP is an entitlement program that helps low-income Americans pay their bills. LIHEAP funding is often used to supplement WAP upgrades. How these funds will be braided with HOMES is not known until the rules are more clear. However, like the HEERA rebates, it may be that a WAP upgrade may be done one year and a HOMES upgrade the following, once a new baseline is established.